Jan 26, 2026

As Trade Wars Escalate, Section 232 Tariffs Aren’t Going Anywhere

The US administration continues to escalate trade tensions with additional retaliatory tariffs. While many of these tariffs result in unavoidable higher costs for U.S. importers, companies can be exempt from - or pay far reduced tariffs - for steel and aluminum if any portion was smelted, melted or poured in the United States. With U.S. importers now staring down the barrel of even higher costs for their goods , it is more crucial than ever to understand where and how savings on these so-called Section 232 tariffs can be applied.

Unlike most tariffs, Section 232 Tariffs are actually supply chain tariffs - they require companies to track where raw materials were first processed. Here’s a quick refresher on Section 232 tariffs, and what they can cost your business if you don't have visibility into the raw materials supply chain for aluminum and steel products.

What are Section 232 Tariffs and How are They Applied?

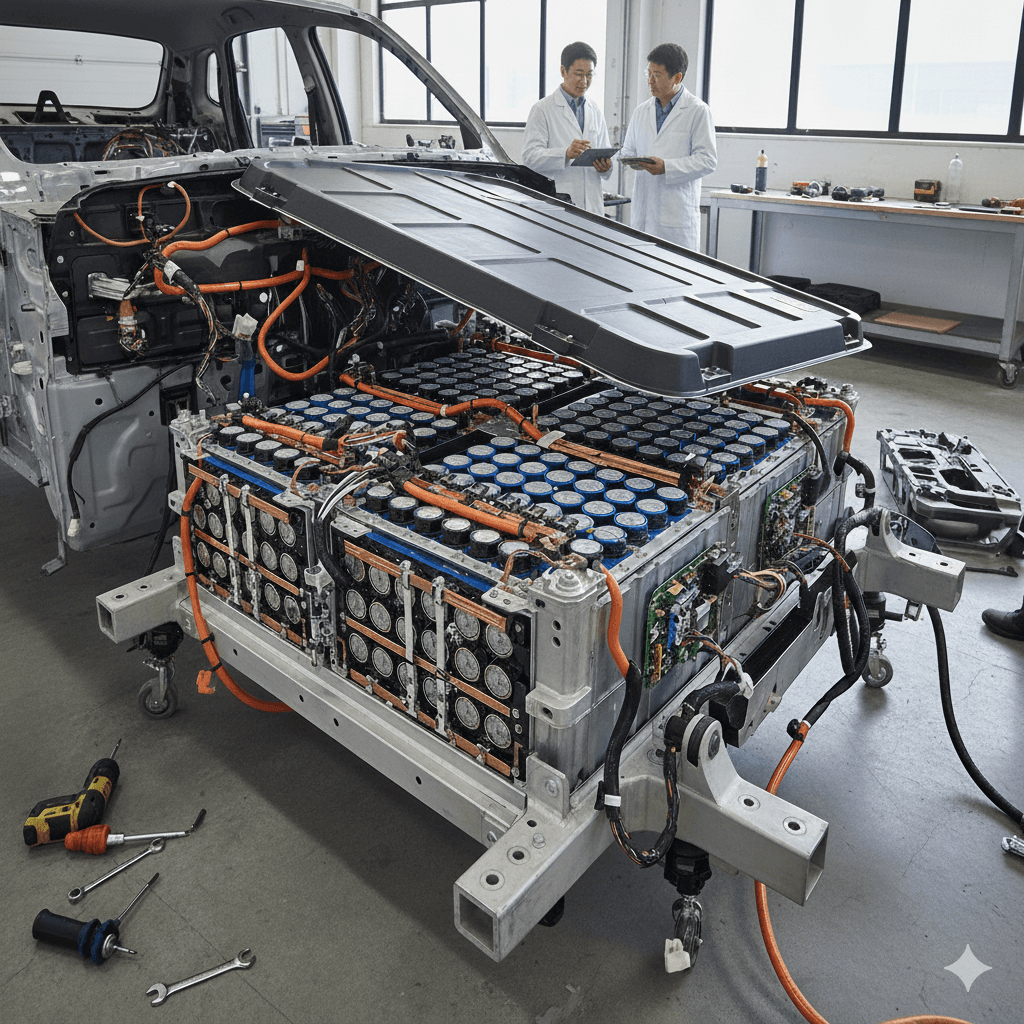

2025 saw a significant expansion of Section 232 tariffs: rates were increased from 25% for steel and 10% on aluminum to 50% across the board, and hundreds of derivative products were included including household goods, machinery, automotive parts, and chemicals.

Businesses Must Know Metal Value and Origin - and Have Proof - To Avoid A Higher Price Tag at Import

Section 232 tariffs on steel, aluminum and copper, like all rule-of-origin tariffs, require businesses to know the origin of the raw material in the product. They also require businesses to know the value of the raw metal, calculated based on the price paid, and to have the proper documentation to prove this.

Companies that don't know the origin of the metals must pay the Section 232 tariff on the entire value of the product - up to 200% in the case of steel. Having the necessary visibility into the supply chain to identify the location of the smelt, melt, or pour can result in businesses paying drastically different tariffs upon import.

Let's consider the recent trade deal that the U.S. struck with Taiwan, stating that the new reciprocal tariffs do not stack on existing MFN (Most Favored Nation) duties. This deal carves out tariff caps for certain goods subject to Section 232 such as semiconductors, auto parts, timber, lumber and wood derivative products, but it leaves many products impacted by Section 232 tariffs unaffected.

With this in mind, let’s calculate a hypothetical tariff cost of a bicycle imported into the U.S. from Taiwan with aluminum parts. In this example, the bicycle imported from Taiwan is valued at $1000 USD at import, and contains aluminum components worth $500. According to the CBP Fact Sheet on Section 232, tariffs should be calculated based on the price paid for the materials. Here are the different amounts in tariffs that this importer could pay under the current Section 232 rules, based on the information - and documentation - that they have access to:

If The Importer Knows The Value of The Metal, But Does Not Know The Origin:

Under the current Section 232 rules, importers who do not know the origin of the metal they are importing must automatically apply a 200% tariff on either the full product value (if the importer does not know the value of the metal) or the value of the metal. In this example, the importer knows the value of the aluminum - $500 - and has the proper documentation to prove the value, therefore the tariff upon import is $1000.

If The Importer Does Not Know The Value of The Metal Or Its Origin:

Not knowing the value of the metal or its origin automatically sets the Section 232 tariff to 200% of the full product value. In this example, the full product value is $1000, therefore this importer would end up paying $2000 at import.

If The Importer Knows The Value of The Metal and Its Origins:

Knowing the value of the metal and its origin can mean the difference between paying $0 in tariffs and up to 200% of the value of the imported product.

If the importer can prove that the aluminum was smelted and cast in the United States - even if raw materials originated from outside of the U.S. - the tariff would be set at $0. Any steel or aluminum imported from outside the U.S. that is not entitled to this exemption would have a 50% tariff applied to the value of steel and aluminum (i.e. the price paid for the metal). Due to ongoing sanctions, Russian steel and aluminum continues to have a 200% tariff applied.

Don’t Leave Money On the Table

A business importing the same $1000 aluminum bicycle could end up paying anywhere from $0 to $2000 in additional tariffs at import depending on how much documentation they had access to and how visibility they have to the first processing stage of the key metals.

With tariffs on the rise and trade negotiations becoming ever more volatile, having the mechanisms in place to properly calculate rule-of-origin tariffs is more important than ever.

Is your business prepared? Sourcemap offers the only section 232 tariff mapping software designed to compile the evidence needed to save millions in tariff costs. To learn about how Sourcemap can help you calculate your tariff exposure, reach out to our team of experts today.