May 2, 2025

How Supply Chain Mapping Can Save 50% in Tariffs

Revised June 5, 2025. Executive Summary: If companies can prove that any of the steel or aluminum in a product was melted and poured in the US, they can be exempted from a 50% tariff - increased from 25% this week - on over $150B in derivative products including machinery parts, household goods, industrial components, and automotive parts.

On February 10, 2025, President Trump made changes to the Section 232 steel and aluminum tariffs, significantly expanding the scope of derivative steel and aluminum products. These changes included:

An increase on aluminum tariffs from 10% to 25%, eliminating all country exemptions, and terminating all existing General Approved Exemptions effective March 12, 2025;

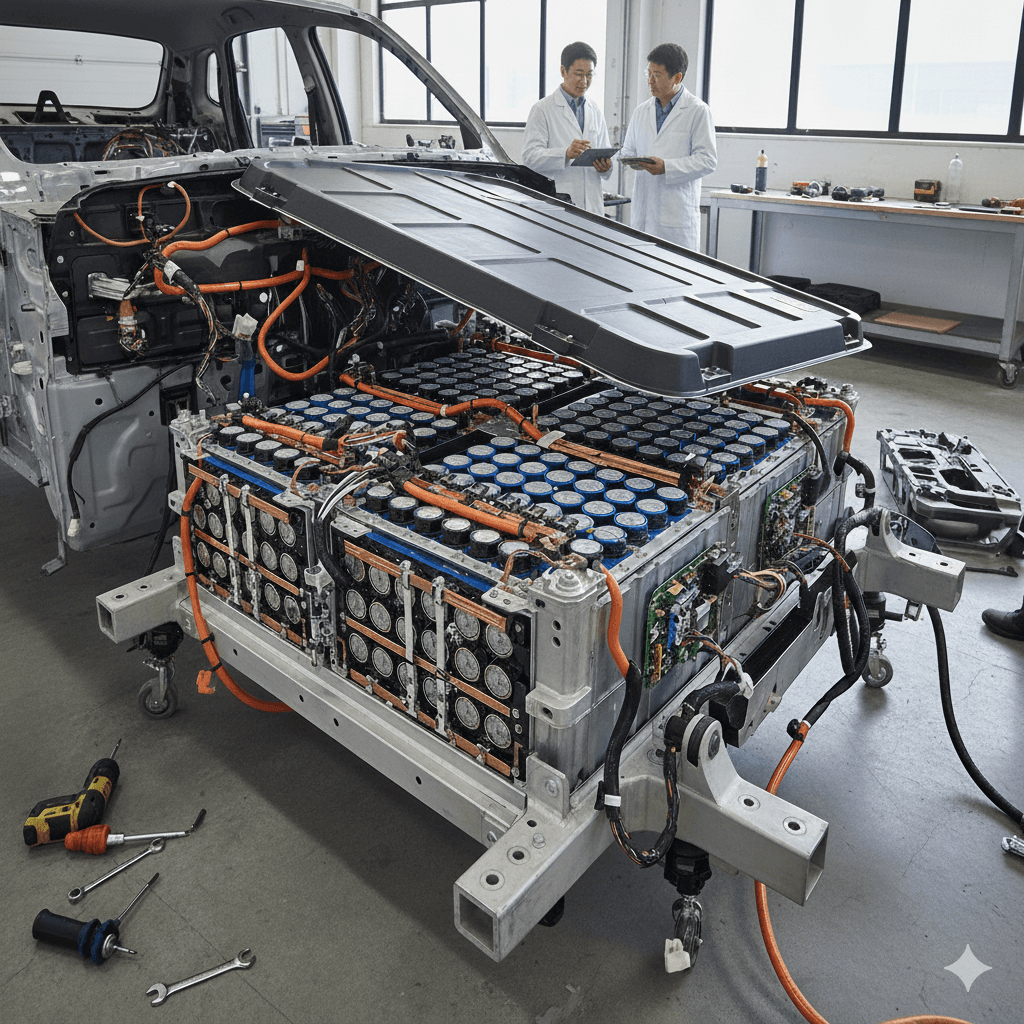

expanding the scope of products covered by the tariffs to over $150B worth of imports across machinery parts, household goods, industrial components, and automotive parts;

prohibiting the Commerce Secretary from considering new product exclusions from February 11, 2025 (entity-specific product exclusions to "remain effective until their expiration date or until excluded product volume is imported, whichever occurs first").

These duties applied to imports from March 12th onward. Based on the most recent import data available, 51% of total imports of aluminum into the United States comes from Canada, with Mexico and China accounting for 22% and 21% of total aluminum derivatives, respectively.

This week, the Trump administration announced an increase of Section 232 tariffs to 50%. Section 232 tariffs are to apply only to the steel or aluminum content of the derivative product and would not apply to derivative products processed in other countries using steel or aluminum that was “melted and poured” (steel) or “smelted and cast” (aluminum) in the United States. This applies to all the listed derivative HTS codes to which the new Section 232 tariffs would otherwise apply, so businesses need to start mapping their supply chains for products in those codes to identify any U.S. product or material.

Calculating the proper tariff amount and taking advantage of exemptions

Tariffs may be applied differently for two similar products made of materials from different countries. For example, a chair made of 100% aluminum from China would incur the following tariffs: 25% pre-existing tariff imposed before 2025 + 50% tariff on steel from China + 25% additional reciprocal tariff on most Chinese goods. Due to the Section 232 exemptions, this aluminum chair would be exempt from the additional reciprocal tariffs imposed by the administration this past week. This results in a tariff rate of 75% for this chair. However, if any of the aluminum used in this chair was smelted and cast in the United States, it would be exempt from the 50% Section 232 tariffs. This exemption exists for both steel and aluminum regardless of where the end product is ultimately manufactured. This creates a strong incentive for companies to ensure they have a record of all of the sources of steel and aluminum in their products, as well as the value of steel and aluminum that is not smelted, poured or cast in the U.S. In order to qualify for this exemption, importers must collect evidence of where the aluminum and steel were melted and poured or smelted and poured - also known as chain of custody traceability.

What Data is Required to Calculate Section 232 Tariffs?

Now that Section 232 applies to aluminum and steel derivatives, importers seeking to be exempt from this 50% tariff need to calculate the value of steel and aluminum in their products and determine which portion of it was melted and poured in the US. This process involves mapping all of the suppliers in the value chain and collecting chain of custody documents such as purchase orders, contracts and bills of lading to prove that the metal was melted and poured in the US.

With only a few months into this new administration, we still don't know how Section 232 tariffs will evolve, nor how many other materials may fall under such origin-mapped requirements. Companies should plan for uncertainty and start mapping their supply chains so that they can respond in real-time to evolving trade regulations.

The European Commission is also introducing a "melted and poured" rule as part of its steel and metals action plan to determine the origin of metal goods, with potential tariffs and other restrictions. With the ever-changing trade and tariff landscape, it's a best practice to determine the source of all in-scope metals for both US and EU regulators.

To learn more about how Sourcemap can help your company with tariff planning and customs compliance , reach out to our team of experts.

Tariffs and what impact can they have on demand?

Tariffs are taxes imposed by a government on goods and services imported from other countries. They are typically a percentage of the price of goods. Tariffs can be used to raise government revenue, discourage consumption of imported or foreign goods and can be used as a tool for political negotiations with foreign governments.

Section 232 of the Trade Expansion Act of 1962 authorizes the President to impose trade restrictions—such as a tariff or quota—if the Secretary of Commerce determines, following an investigation, that imports of a good "threaten to impair" U.S. national security.

While the impact of tariffs is heavily dependent on the industries impacted, as well as the nature of the trade deficit with the foreign government(s) in question, there are several potential outcomes when tariffs are imposed. Since tariffs are calculated as a percentage of the price of goods, some producers may increase the cost of their products to offset the revenue loss. This is most common for industries where there is limited or no domestic alternative to the imported goods. For example, several US car producers have warned that since the cost of the imported materials that are necessary for the production of their cars will be significantly more expensive, the price tag for those cars may go up for consumers.Targeted industries will face lower export demand in the countries on which tariffs are imposed. As their goods have become relatively more expensive in the importing country, this can lead to lower sales and lost market share as consumers switch to relatively cheaper domestic goods. The degree of this decline depends on the price elasticity of demand and how much consumers adjust their purchases of imports in response to the higher prices caused by the tariffs. This may occur if there are few alternatives in the domestic market, or consumers have a strong brand preference.

On the other hand, some domestic industries may benefit from the reduced foreign competition for their goods, especially industries that do not rely heavily on imported materials. Increasing the price of foreign-made goods for consumers may increase demand for domestic products in the long term. Finally, retaliatory tariffs are a fairly common response from foreign governments. Retaliatory tariffs were imposed on U.S. exports as a result of the announcement of Section 232 tariffs during the first Trump administration, some of which were suspended after negotiations. The Trump administration granted exceptions to certain countries including Canada and Mexico during this period, while the Biden administration granted a temporary tariff suspension on Ukraine.

Recent changes to steel and aluminum tariffs

In 2018, President Trump proclaimed a 25% tariff on steel and a 10% tariff on aluminum imports from most trading partners under Section 232. At the time, the then Commerce Secretary determined that steel and aluminum imports were threatening to impair U.S. national security by “weakening” the U.S. economy. In 2020, President Trump expanded the tariffs to include certain derivatives of steel and aluminum, and the Biden administration largely maintained these tariffs while increasing tariffs on Russian aluminum imports. During both the Trump and Biden Administrations, the United States negotiated exemptions for some U.S. trading partners and granted entity-specific exclusions as well as General Approved Exclusions applicable to any importer.

To learn more about how Sourcemap’s n-Tier mapping solution can help companies reduce their tariff exposure, reach out to our team of experts.