Aug 11, 2025

Section 232 Tariff Update - Tariffs for Non-U.S. Copper Set at 50%

Section 232 tariffs impose restrictions and additional costs on certain imports if the Secretary of Commerce and the President determine they are a threat to national security. To date, Section 232 tariffs have been imposed on steel, aluminum and their derivatives, automobiles and auto parts, and, as of last week, copper. These tariffs are considered rule of origin tariffs as they take into consideration where products have been produced or manufactured, not merely where they have been shipped from.

Steel and aluminum tariffs, currently set at 50% as of June, include exemptions for any steel that was melted and poured or aluminum that was smelted and cast in the United States - regardless of where the steel and aluminum originated.

Given the high tariff rate on these imported goods, companies are incentivized to identify any applicable exemptions by mapping their supply chains for steel and aluminum derivatives to identify any U.S. production. To account for this exemption, U.S. Customs and Border Protection has updated Form 7051 to include the Country of Melt and Pour, Primary and Secondary Country of Smelt and Country of Cast for Section 232 Tariffs.

U.S. sets 50% tariff on copper derivatives

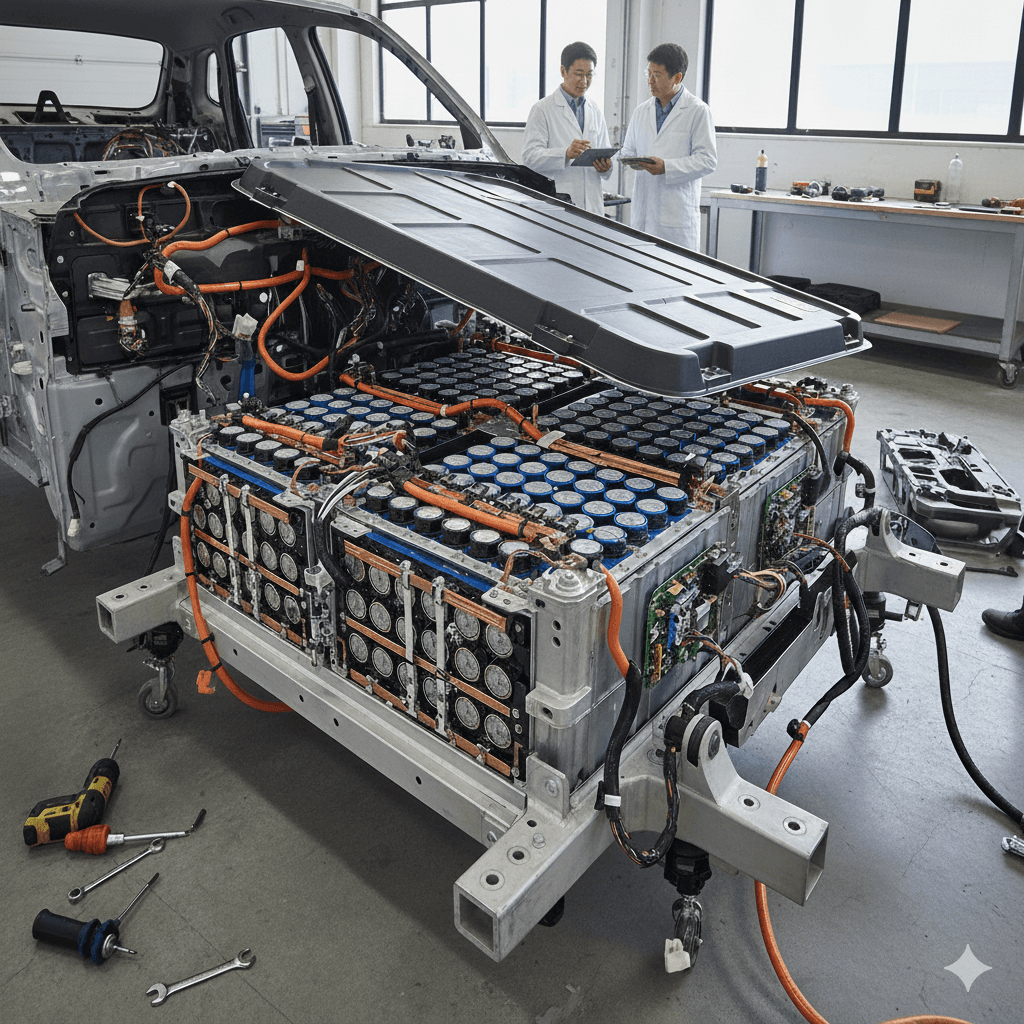

As of August 1st, the U.S. imposed a universal 50% tariff on non-U.S. semi-finished copper and intensive copper derivative products. The non-copper content of any products subject to this tariff would also be subject to applicable reciprocal tariffs, with the exception of cars and auto parts which will only be subject to automobile tariffs.

Learn More

Section 232 tariffs are constantly evolving. Investigations are currently underway to possibly include timber, lumber and derivative products such as paper and furniture, pharmaceuticals, and semiconductors in expanded Section 232 tariffs this year. In 2024, the U.S. imported roughly $24.5B worth of timber and derived products, $212B worth of pharmaceutical products, and approximately $60B worth of semiconductors.

Has your business properly calculated its rule-of-origin tariff exposure? Sourcemap's n-Tier Tariff Mapping Solution automates the upstream supplier discovery and documentation collection these imports now require. Learn more about automating tariff compliance and reach out to our team of in-house policy experts today.