Nov 18, 2025

Tesla's China-Free Supply Chain Mandate: What Every Automotive OEM and Tier 1 Needs to Know About n-Tier Mapping

Tesla is requiring its suppliers to exclude all China-made components from vehicles produced in the United States within the next 12-24 months. According to recent reports, the company has been working on this strategy since the COVID-19 pandemic but accelerated the timeline this year in response to escalating tariffs and geopolitical tensions.

This isn't just a Tesla story. It's a preview of what's coming for the entire automotive industry.

The challenge Tesla and other manufacturers face is straightforward but difficult to implement: that's because most OEM's and Tier-1's have little visibility into their supply chains beyond direct suppliers. When your Tier-1 supplier in Mexico sources from a Tier-2 facility in Vietnam that sources raw materials from a Tier-3 in China, neither you nor your Tier-1 are likely to know about that Tier-3 relationship. Modern automotive supply chains typically span 5-10 tiers from raw material extraction to final assembly, and that complexity creates significant blind spots for geographic sourcing compliance.

How Could Such a Mandate be Pulled Off?

While auto parts may not come from China, tier-2 and tier-3 components (and raw materials) may - and in many cases, that would make them subject to high tariffs and strict regulations - including those subject to CBP detention.

Companies have traditionally relied on trade statistics to estimate where their parts’ tier-2 and tier-3 components are sourced. But these approaches are probabilistic, tend to flag numerous false positives, and won't stand up to regulatory scrutiny for any company seeking to prove an exemption:

AI trade data sounds promising—until you realize it's only based on customs records that are missing any part-level detail, and lacks information on contracts between suppliers - so any company that has ever transacted with supplier is assumed to be a current supplier.

Supplier questionnaires only achieve 20-40% response rates, take 3-6 to get a response, and only work with the suppliers you already know. In most cases, the data needed to prove origin has to come from a tier-2 or tier-3 (or tier-4) supplier.

Commercial supplier databases provide generic industry snapshots that are outdated the moment you receive them. They can't track the dynamic reality of suppliers adding and removing upstream partners, and they don't provide the transaction-level verification that compliance requires.

What a Secure Supply Chain Looks Like

Tesla's situation illustrates three challenges that every automotive OEM will face:

First, you need component-level origin verification. It's not enough to know where your Tier-1 supplier is located. You need to know where every sub-component was actually manufactured. Reports indicate Tesla has been working with Chinese suppliers to establish operations in Mexico and Southeast Asia—but that only works if you know which suppliers need to move and which components they produce. Without n-tier mapping, you're asking Tier-1 suppliers to certify origins they don't actually know.

Second, you need transaction-level documentation. Whether you're managing Tesla's requests, tariff classifications, forced labor or deforestation compliance, regulators may ask to see transaction documentation as evidence of specific supply chains. This can't be achieved through periodic audits or sampling—it requires ERP-integrated systems that automatically capture documentation as transactions occur.

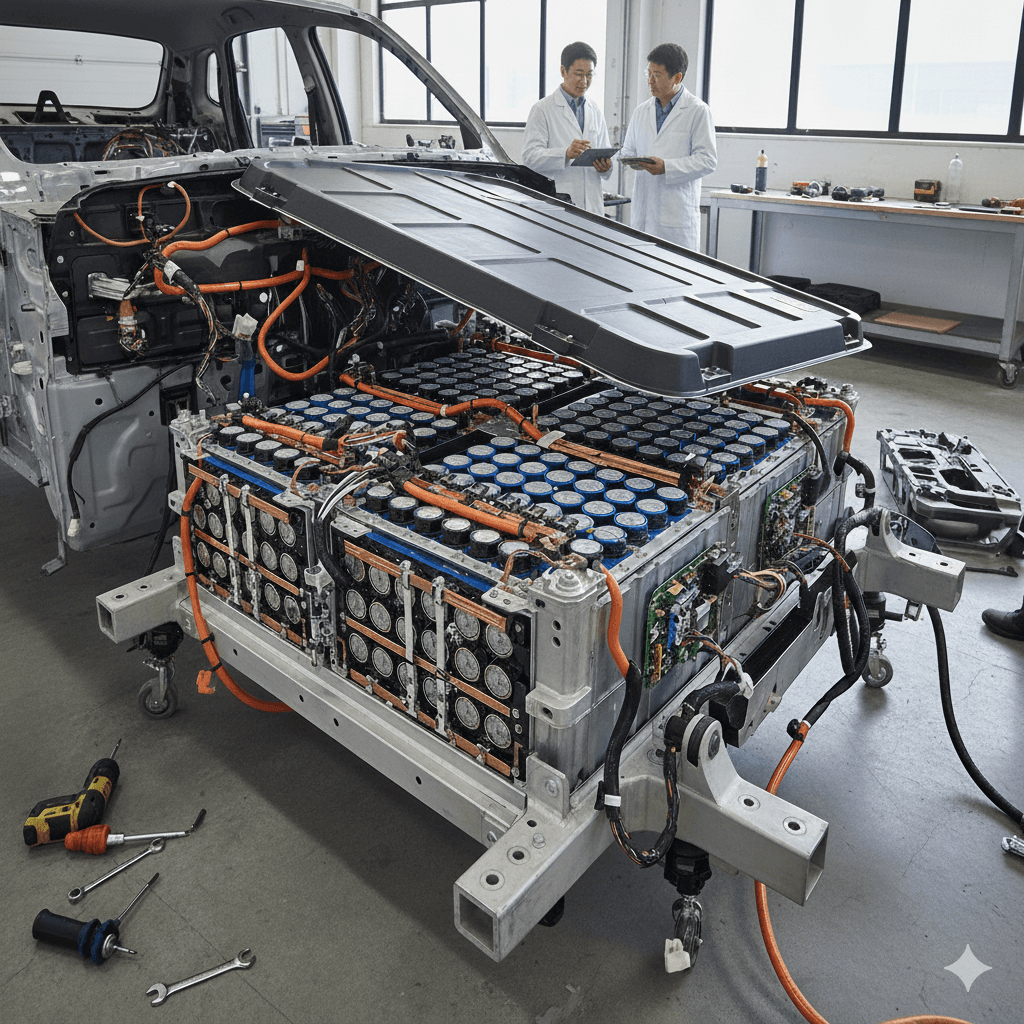

Third, you need to understand supplier concentrations. Recent export restrictions on rare earth elements and semiconductors have shown how concentrated production can be for critical components. Tesla's CFO acknowledged in April that manufacturing lithium-iron phosphate batteries in the U.S. "will take time"—some alternative sources require years of capital investment to develop. An n-Tier mapping solution built on a graph database can automatically scan your supply chain for dependencies against your Bills of Materials to provide actionable procurement guidance.

What Supply Chain n-Tier Mapping Actually Achieves

Supply Chain Mapping is much easier once you use an automated solution. Here's what happened when an automotive manufacturer implemented Sourcemap's cascading supplier network:

Within 6 weeks, they identified the actual (verified) tier-4 sources of all materials being mapped

Their supplier database grew by an astonishing 26x when accounting for tier-2 to tier-n suppliers

Response rates in Tier-1 (100%) and Tier-2 (94%) exceeded all expectations

Dozens of raw materials suppliers that had never been audited were identified in the process

Supply Chain Mapping Matter More than Tesla

While Tesla's China-free mandate is driving headlines, OEMs that have implemented comprehensive n-tier mapping are finding value in areas that go well beyond secure sourcing:

You can secure strategic materials directly. One automotive manufacturer used n-tier visibility to identify specific mines and refineries for EV battery components, then negotiated long-term contracts directly with those suppliers—securing over $100 million in supply value. When you know exactly where critical materials come from, you're not at the mercy of intermediaries.

Tariff optimization becomes manageable. With transaction-level visibility to origins, one manufacturer reduced tariff exposure by 10-50% on metals imports through strategic sourcing adjustments. When tariff regimes change—and they're changing frequently—you can model the impact across your entire supply chain in days instead of months.

You can consolidate redundant suppliers. A global luxury conglomerate discovered they had different brands contracting with the same sub-suppliers at different prices. By consolidating those relationships, they saved over €85 million while actually expanding compliance coverage.

Real-time risk monitoring becomes possible. Instead of discovering forced labor or human rights issues after CBP detains your shipment, you can screen all upstream suppliers continuously against regulatory watchlists and get alerts before problems reach your border.

What Separates Successful Programs from Failed Pilots

The difference between programs that work and those that stall out comes down to three things:

Cascading disclosure, not broadcast surveys. The most effective approach is to have each supplier invite their own suppliers, leveraging existing relationships. This achieves dramatically higher participation rates than sending surveys to suppliers you don't even know exist.

Verified participation, not algorithmic guesses. Regulators distinguish between suppliers who actively disclose their upstream relationships versus AI probability scores. If you can't provide documented evidence during an audit or CBP detention, algorithmic inferences won't help you.

Integration with your existing systems. N-tier mapping needs to connect to your ERP, procurement, and inventory management systems to be sustainable. Standalone compliance platforms that operate separately from how you actually run your business typically fail to maintain the continuous data updates you need for ongoing compliance.

The Bottom Line

Tesla's move to exclude China-sourced components is a leading indicator of where the industry is headed. Whether driven by geopolitical tensions, regulatory requirements, or strategic sourcing, the ability to verify component origins across all supply chain tiers is becoming a fundamental operational capability.cThe question isn't whether you need this capability—it's whether you can implement it quickly enough to stay ahead of the next regulatory shift or customer mandate.

Sourcemap has been helping automotive OEM’s and Tier 1's implement verified n-tier supply chain mapping for over 15 years. Our automated supplier graph network achieves unprecedented supplier discovery rates in days, with an audit trail that exceeds the evidentiary standards regulators require. To learn more about how we can help your organization achieve comprehensive supply chain visibility, visit sourcemap.com or contact our team.