Apr 27, 2022

The S in ESG: A Serious Consideration for a Low-Carbon Future

As companies look towards a low-carbon future, our changing energy landscape rests on the shoulders of clean energy technologies. These technologies often rely on key metals and involve more mineral intensive operations as opposed to fossil fuel-based technologies. And integrating an environmental, social and governance (ESG) framework will play a major role in successful corporate transitions.

However, within that ESG framework, the “S” or social aspect of the triangle, often comes up short. While companies are asked to disclose their ESG and climate-related risks using various frameworks, those reports pay less attention to the social risk and management practices and focus more on the company’s climate-related risks.

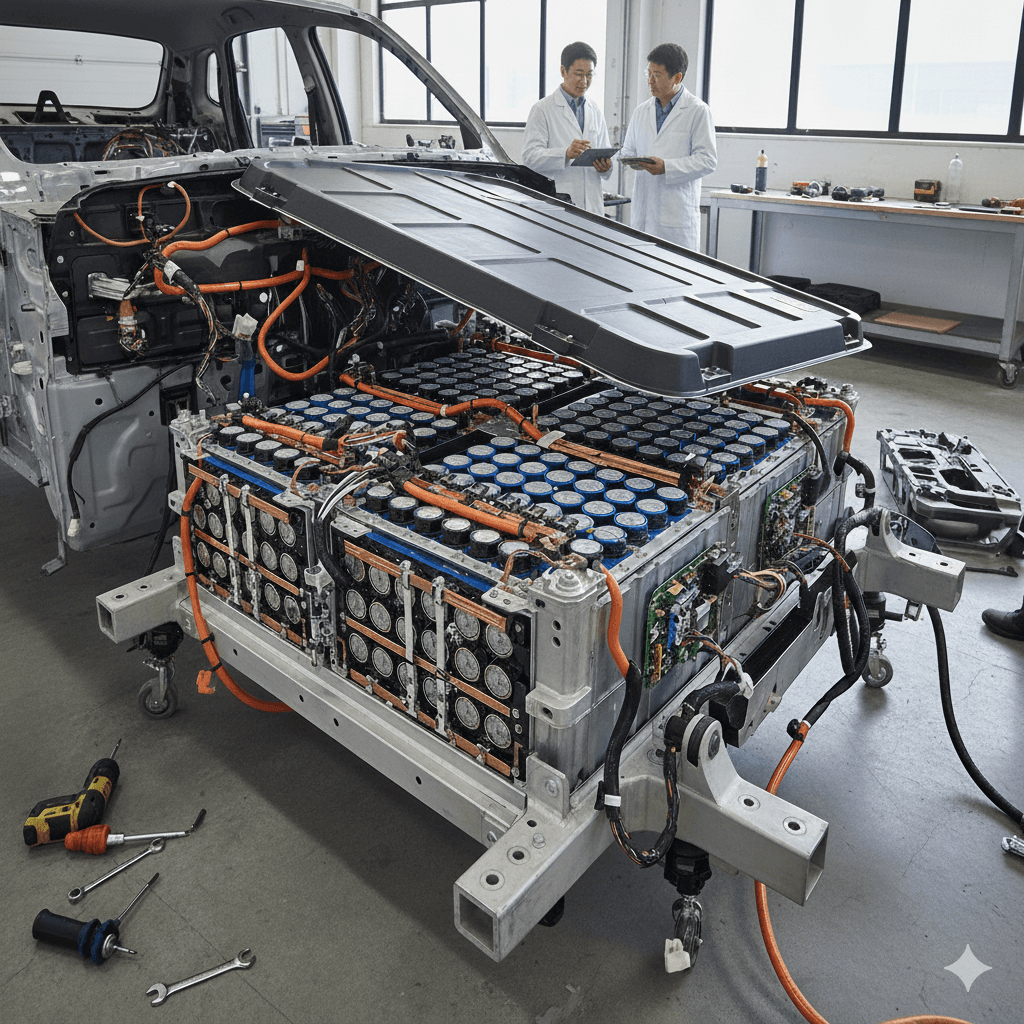

Renewable energy plants producing solar and wind require more minerals, such as copper, lithium and cobalt, than hydrocarbons-based facilities. For instance, an electric car requires six times the mineral input compared to a conventional car, while an onshore wind plant requires nine times more mineral resources than a typical gas-fired plant. Clean energy technologies often rely on certain key metals which will be necessary if these technologies are expected to expand and thrive.

Two metals in particular, lithium and cobalt, have seen supply chain fears in recent years. Lithium is a vital ingredient of lithium-ion batteries. These are used in everything from smartphones to electric vehicles (EVs), which are now their biggest consumer. The lithium-ion battery is also the battery of choice for most car makers, including Tesla, Ford, and Nissan. Cobalt is produced mainly as a byproduct of copper and nickel mining, and is another essential component of the cathode in lithium-ion batteries. In addition, it has other uses in military and industrial applications.

Metals extraction is not without social risks and as we strive for a cleaner technology agenda, installation of frameworks will lead to a larger material footprint. Monitoring the social aspect of the ESG framework will require companies to disclose data at the asset level of each mining operation, rather than aggregated data that may be taken from headquarters. Since different countries and communities face varying ESG challenges, this type of observation becomes particularly important. While disclosure alone won’t solve the complex issues of equitable workplaces or climate change, more improved ESG risk mitigation tools and mechanisms might be a good place to start.

It is projected that social risk will pose the highest restriction on the extraction of minerals in years to come. Social considerations – such as local community impact and the need for fair and equitable working conditions – will intensify and become significantly more important. Recognizing the importance of the “S” in ESG frameworks and stressing its value will be vital in the way companies involved in the energy transition go about their business, including those that involve mining.

Environmental, Social and Governance (ESG) Framework Key to Clean Energy Technologies

As we put clean air technologies and low-carbon goals into practice, monitoring these risks will be critical for a sustainable and environmentally friendly energy transition that will benefit the success of businesses and provide goodwill in communities.

Sourcemap offers an all-inclusive business continuity solution built on the world’s leading supply chain mapping software. For more information, and to identify how your supply chain might be impacted, reach out to Sourcemap’s team of experts.